Will You Get Your Maximum

Social Security Benefit?

Retirees who don't may miss out on $500,000 or more in lifetime benefits!

Watch the video above to discover why I decided to create a new Social Security planning course after seeing countless retirees fail to make the right claiming decisions to get the most out of their their Social Security benefits.

Now is your chance to get my brand new Social Security planning course "Optimize Your Social Security" and make sure you don't get less than the maximum benefit you are entitled to.

Get it now for only $197

Let Me Tell You A Secret About

Claiming Social Security

The "average" American receives the same amount no matter when they claim

So that means it doesn't matter when you claim, right?

Wrong!

This would be true if you happen to be the "average" American. But you are not.

Everything that is unique about you – your background, education, income, etc. – all influence your life expectancy. That can increase or decrease the optimal age for claiming, but most people reading this will likely live longer than the average American.

Why?

Simply because being the type of person who might seek out an online course on claiming Social Security (a sign of intelligence), and the type of person who even has resources to make that a potential reality (a sign of wealth), would likely suggest that you have a longer life expectancy than most Americans.

And even if your current health makes this untrue for you, your spouse or other loved ones could be impacted by your claiming decision.

So if you want to make sure you get the most from your Social Security benefit, you have to first understand how you are different from the "average" American. Once you have this knowledge, you can skew the Social Security math in your favor.

Optimize Your Social Security is not just a collection of tips.

We show you how to actually carry out a sophisticated maximization

analysis on your own!

Fortunately, you don't need to be a math whiz to do a Social Security analysis.

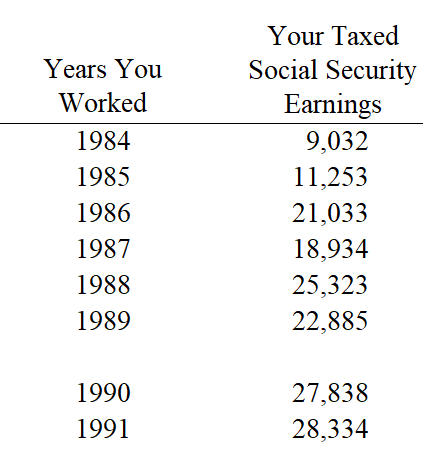

If you can read a table like the one below and type numbers into boxes, then you have the technical skills you need to carry out a sophisticated Social Security analysis.

Financial advisors charge $1,000 or more

for a Social Security analysis!

But you don't have to pay an advisor...

We'll show you how to use the same software used by many financial advisors to conduct a Social Security analysis for their clients – at a much lower cost!

Financial advisors may charge a $1,000 or more for a Social Security analysis. And even then, many advisors don't specialize in Social Security or may not have the right tools to give you the best guidance.

We'll show you how to do it right, yourself!

And we'll show you the powerful industry software that you can use for only $40 to get it done.

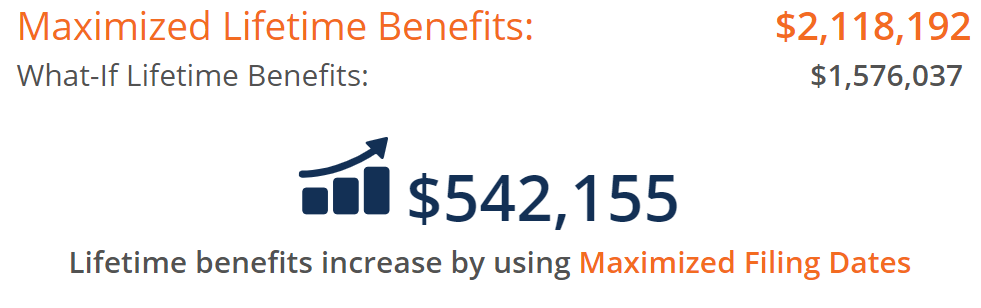

Don't miss out on $500,000 or more

by making the wrong claiming decision!

Most Americans are unaware of how much they may miss out on...

Don't be like most Americans and overlook the increase in benefits you can receive from being savvy about your claiming decision.

When comparing the best and worst case claiming decisions, differences in lifetime benefits are often $500,000 or more.

It's not that some differences tend to be large. Most cases have very large differences, even when your situation may seem simple.

Check out this example below. This wasn't an outcome I had to hunt for. I opened an old report at random and this was the first result I found.

About Prof. Derek Tharp, Ph.D., CFP®, CLU®, RICP®

Maybe you are wondering: Why should I take a course run by this guy?

I'm Derek Tharp, I'm a finance professor and financial planner. Over the past 10 years, I've taught hundreds of students and clients the ins and outs of getting the most out of their Social Security benefit. I regularly write at Kitces.com and The Wall Street Journal's Experts Blog. Additionally, I've published award-winning financial planning research and I've been quoted in outlets such as The New York Times, Money Magazine, and The Washington Post.

But, most importantly, I believe that designing a good online course means designing a course that drives action. This course isn't just a bunch of theory. We'll cover some of that, of course, but the real value in this course is taking you through the step-by-step process of calculating your own maximized Social Security benefit.

Here's What You Get When You

Buy the Optimize Your Social Security Course

The Optimize Your Social Security course is divided into 3 modules of content, each including video lessons, resources, and tutorials all helping you maximize your own Social Security benefit.

The Course Modules

Module 1

Understanding the Rules of Social Security

- Misconceptions about Social Security

- Social Security's role in retirement income planning

- How Social Security is calculated

- General strategies for maximizing benefits

- Dealing with the Social Security Administration

Module 2

How to Read Your Social Security Statement

- How to read your Social Security benefit statement

- Key assumptions to understand

- Why the benefit stated on your statement may be wildly inaccurate

- What to do if corrections to your earnings history are needed

Module 3

How to Run a Social Security Analysis

- How to gather your earnings history

- The industry software available to you for only $40

- Step-by-step instructions on how to navigate this software

- How to read and interpret your maximization results

This course also includes guidance on some of the most difficult Social Security issues to sort out:

- Will your Social Security benefits be reduced?

- Will you avoid the Social Security Windfall Elimination Provision (WEP)?

- Will you avoid Social Security's Government Pension Offset (GPO)?

- Do you qualify for Social Security disability benefits?

- Are you eligible for Social Security benefits if you are divorced?

- Are you eligible for Social Security benefits as a surviving spouse?

- Will your Social Security be taxed?

Click the button below to gain access to Optimize Your Social Security:

Get it now for only $197

faq

That's okay! This course is designed to walk you through the process step-by-step. If you can read numbers off of your statement and enter them into boxes, you should be fine.

No. We guide students through the use of third-party software that costs $40 for an annual household license. We have no financial relationship with the provider of this software.

Yes! If you aren't 100% satisfied with this course, let us know within 30 days and we will provide a full refund.

Yes! We will guide you through the process of using industry software step-by-step.

No. We have no financial relationship with the tool recommended in this course. We simply recommend it based on the quality of the tool.